The recording and QA markets are evolving and acquisitions have resulted in major challenges and opportunities for customers and vendors. If either NICE or Witness fail to execute, customers are not going to give them a second chance, with those who view logging and QA solutions as mission critical quickly investing in new products. This means that Verint and previously little-known players such as Envision and Mercom may rise to prominence. And eTalk, once a leader in the QA side of the market, may have a chance to regain some of its previous glory.

The recording and QA markets are evolving and acquisitions have resulted in major challenges and opportunities for customers and vendors. If either NICE or Witness fail to execute, customers are not going to give them a second chance, with those who view logging and QA solutions as mission critical quickly investing in new products. This means that Verint and previously little-known players such as Envision and Mercom may rise to prominence. And eTalk, once a leader in the QA side of the market, may have a chance to regain some of its previous glory.

These are tough times for system users and prospects and the logging/QA market place is very likely to continue to experience growing pains and mergers. Prospects have to realise that there is no safe investment but there are ways to minimise risks.

Prospects shouldnt delay purchase decisions, as it will take 18 to 24 months before the full impact of these mergers are realised and that is too long to wait to buy a new system. But prospects should insist on investment protection for any products purchased in the current market to ensure that a new investment isnt made obsolete the day the sale is closed.

The fight is on

Mergers and acquisitions are altering and disrupting the landscape of the mission-critical liability recording and quality assurance (QA) markets. NICE and Witness , each of which has acquired a UK-based competitor in the past few months, are fighting over leadership in the market, based on installed base of the merged companies.

Todays market share leadership position is almost irrelevant as it will take 18 to 24 months to see how well NICE and Witnes s absorb their acquisitions and are able to build financially viable companies. To do so they will need to prove that they can execute and sell well around the globe, have mature and stable products and support, a highly referenceable customer base and a vision for delivering value in the future.

The Challenger

Verint (previously known as Comverse) is the third largest company in the call logging/QA market, based on revenues and market share. After Nice and Witness complete their respective acquisitions, Verint will be substantially smaller in terms of revenue and installed customer base than either of the two market leaders, but for now it is viewed as the most stable and focused full-featured alternative in this evolving market.

The problem for Verint is that its either going to have to make a similar move or accept its new niche status, as revenue size and install base make a significant difference in a companys ability to execute, sell and realize its vision by giving a company a larger R&D budget.

Historical Perspective

The call logging/QA market consists of four sectors:

1) Public Safety – provides logging equipment for 911 and other emergency-oriented call centers;

2) Air Traffic Control includes Federal Aviation Administration (FAA) and air traffic control;

3) Financial Trading & Liability Recording provides total recording solutions for trading floors, brokers, sales and any other organisation that needs to be able to capture and replay calls for verification purposes; and

4) Quality Monitoring (QM) provides logging and quality assurance solutions for inbound and outbound call and contact centers.

The quality monitoring solutions have been evolving during the past four years and the more complete suites generally include the following capabilities: 100 per cent recording and advanced playback, ability to record voice and data activities simultaneously, capacity to handle multiple channels (voice, email, chat, collaboration), computer telephony integration (CTI ) interfaces, software for analysing agent performance and analytical applications for identifying trends.

During the past two years, weve seen vendors differentiate themselves by enhancing their suites with e-learning capabilities, speech analytics, advanced reporting, and OLAP.

Quality Monitoring Searches for a New Identity

Another wrinkle in the call logging/QA market is its internal identity crisis. As customer relationship management (CRM) loses its cluster, many logging/QA vendors have been searching for new market positioning even as their products basic functionality – logging and quality assurance – remains essential to call and contact centres and has a rapid return on investment (ROI ).

These vendors are looking to reposition as providers of performance management and optimisation products, which is now one of the hottest buzzwords in the contact centre market because these offerings are perceived as an effective way to improve productivity and quality.

The reality is that recording and QA are important feeds into performance management and optimisation and over time, these vendors may build offerings that allow for the real-time collection and distribution of data needed for performance management. At the moment, however, none of the QM vendors provide effective contact center performance management and optimisation products and all of them have a long way to go before they will get there.

Market Share

Consolidation has shaken up all four sectors of the logging/ QA markets throughout the world but it will take 18 to 24 months before its impact is fully appreciated. Merging successfully with minimal customer disruption is hard, despite all good intentions. Weve seen acquisitions in other markets succeed, such as Siebel purchasing Scopus a few years ago. And weve seen vendors acquire their competitors and fail, as when Peregrine bought Remedy.

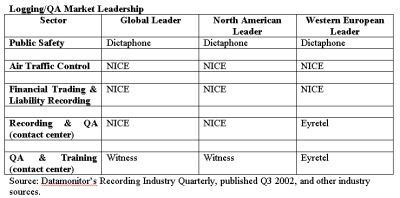

This table reflects the market share leadership for each of the sectors of the logging/QA market prior to the acquisitions by NICE and Witness. There are also many small and little-known vendors in this market, including Envision, eTalk and Mercom.

This table reflects the market share leadership for each of the sectors of the logging/QA market prior to the acquisitions by NICE and Witness. There are also many small and little-known vendors in this market, including Envision, eTalk and Mercom.

Dictaphone remains the dominant player in the public safety segment of the logging/QA market on a global basis, but Thales is considered number two and Mercom number two in the North American market. NICE purchased Thales for its public safety business, as it had no presence or product in this sector.

Witness purchased Eyretel for its hardware-based 100 per cent logging capabilities and its UK, European and Asian presence, markets that Witness has not been very successful in entering. As Eyretel was primarily a logging solution with QA and analytics and Witness a QA solution with logging and analytics, there is product overlap that will have to be addressed in their new product roadmap.

Previous Merger Experience

While previous merger experience isnt a fail-safe way to predict future success, its an important factor to consider. Witness is new to the merger business and while theyve done a few mergers during the past few years they acknowledge that all have been on a small scale until now.

This doesnt mean that Witness wont be able to pull off the merger successfully, but as any of us whove done mergers knows, they are very complicated, high-risk endeavours. But you cant count Witness out as theyve shown their mettle when they successfully broke into this market and woke it back in 1997/8.

NICE has completed six acquisitions since it purchased Canadian-based Dees for its QA capabilities in 1997. Since that time, NICE has done at least one acquisition per year, and has bought three international companies. NICE initially struggled to absorb its first two acquisitions in 1997 and 1998 but since then has been very effective and successful in consolidating its acquisitions with minimal customer impact.

Future Product Support

The question for system users isnt the name of the company or person currently supporting their products but rather what products and services are going to be supported in the future.

Customers are looking for investment protection and want to be sure that their mission-critical software will be enhanced and supported, as was expected when they made the purchase, for as long as they need.

Most standard software contracts state that the surviving company is required to provide support for products for a period of only one year or one release after a merger, whichever is longer. This puts more than half of the logging and QA system users throughout the world at risk.

According to Nancy Treaster, SVP Global Marketing, Witness will support the current Eyretel and Witness product releases for a minimum of 18 months. However, we may not push upgrades for some time even after that. Migration support will be in place, although engineering resources would be focused on the most current platform.

Jim Park, President of NICEs CEM Division reports that they intend to support our acquired base of Thales Contact Solutions (TCS) customers and deliver a smooth migration path to ensure their satisfaction moving forward. NICE is committed to support and nurture this install base. Dropping support for TCS products would counter our intention to cross-sell on top of those products additional applications. All existing service and support agreements will continue to be honoured. And, as with any product, the acquired Thales solutions are subject to an ongoing programme of product enhancements which will ensure our customers’ investment is secure.’

Financial Stability

In a recessionary economy cash is king and after the mergers are complete, cash will be an important indicator of each companys ability to execute. A great deal of cash, generally more than what was originally anticipated, will be needed to make the mergers successful.

Witness made a cash offer of 25 pence for each Eyretel share and values the companys entire issued share capital at approximately 37.4 million pounds, or $59.8 million. Witness has already acquired 85 per cent of Eyretels stock.

NICE closed its transaction with Thales in November 2002, paying $30 million in cash and 2,187,500 shares of NICE stock, which gave previous Thales stockholders 14% ownership of NICE. NICE has $68.7 million in the bank post acquisition. Verint, which has yet to do a major acquisition in the logging/QA market, has $90 million in cash.

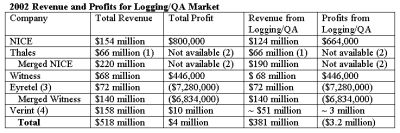

Eyretel, Nice, Thales, Verint and Witness which together represent significantly more than 50 per cent of the logging/QA markets – generated approximately $518 million in revenue in calendar 2002 of which approximately $381 million came from the logging/QA markets, illustrated in the table below.

The table shows that 2002 was a tough year to make a profit in this market. Verint s estimated profits of $3 million were the greatest and is significant as their estimated revenues were the smallest of the five vendors listed in the table. All five vendors concentrated on cost containment in 2002 and are doing so again in 2003.

The table shows that 2002 was a tough year to make a profit in this market. Verint s estimated profits of $3 million were the greatest and is significant as their estimated revenues were the smallest of the five vendors listed in the table. All five vendors concentrated on cost containment in 2002 and are doing so again in 2003.

Note:

(1) Estimated US GAAP.

(2) Thales was a private company and has not yet publicly disclosed this number.

(3) UK-based Eyretel reports every six months. The numbers included in the chart are for the 12-month period ending September 30, 2002, as its most recent financials are not yet available.

(4) Verint does not separate out revenue for its logging/QA products. However, based on their guidance, its estimated that their Enterprise Business Intelligence (EBI) unit represents approximately 40 per cent of overall sales and profits. The EBI includes two basic product groups the logging and QA products that make up the majority (approximately 80%) of this unit and the Loronix Video Business Intelligence products that make up the remainder.

Donna Fluss

Donna Fluss is the Principal of DMG Consulting LLC, delivering customer-focused business strategy, operations and technology for Global 2000 and emerging companies. Ms. Fluss is a recognized leader and visionary in customer relationship management and a highly sought-after writer and speaker. She is the author of the new, industry-leading 2004 Quality Management/Liability Recording Product and Market report. Contact Ms. Fluss at [email protected].

Performance Management