Although multi-megabit broadband is already available in some European countries,

Although multi-megabit broadband is already available in some European countries,

Sweden is pointing Europe in the same direction as pioneering Asian countries such as Korea and Japan.While most of Europe is still delivering sub-2 Mbps broadband to consumers, the major operators in Sweden are moving to much higher speeds, says the Yankee Group.

Sweden is pointing Europe in the same direction as pioneering Asian countries such as Korea and Japan.While most of Europe is still delivering sub-2 Mbps broadband to consumers, the major operators in Sweden are moving to much higher speeds, says the Yankee Group.

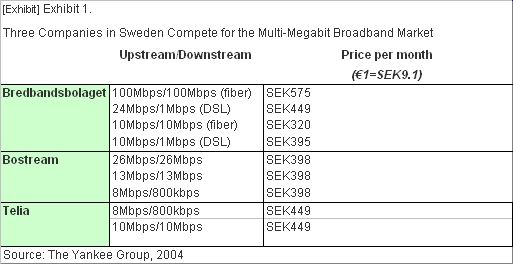

Three companiesBredbandsbolaget, Bostream, and Teliaare competing to dominate the multi-megabit broadband (MMB) market in Sweden, each offering multi-megabit DSL at a relatively low price (see Exhibit 1). For the purposes of this Yankee Group Research Note, we define MMB as any service that offers a download speed greater than 2 Mbps.

Market Analysis

Bredbandsbolaget, also known as B2 , is the multi-megabit pioneer. The company has been wiring apartment blocks to its Ethernet networks for 4 years, and now has 120,000 customers (43 percent of homes connected to the fiber) getting either 10 Mbps or 100 Mbps symmetrical broadband service. The company pulls fiber into the basement of the building, and uses Cat5 Ethernet cable from there to apartments.

Late last year, B2 began offering DSL over unbundled local loops rented from Telia. For customers up to 1200 meters from the exchanges, it offers a 10Mbps/1Mbps service. For customers within 500 meters, it offers 1ADSK2+ at 24Mbps. About 40,000 DSL customers are connected. We believe this is the only European Ethernet over copper service for residential users that is running at wire speed to an Ethernet switch.

B2 offers a voice service at SEK99 (1=SEK9.1) per month plus call charges that has attracted about 50,000 customersor approximately 40 percent of the installed base. B2 also offers a VoD service, but the company is not marketing it aggressively.

Telias reaction has been to implement the highest speed broadband service available from any European incumbent telco. It has 8 Mbps and 10 Mbps services; which service customers receive depends on their location. In May, Telia announced it was upgrading 250 exchangesserving 400,000 householdsto provide 8 Mbps service. Telia claimed to have 423,000 subscribers at the end of March.

Bostream, another participant in the market, offers a VDSL-based service at up to 26 Mbps to customers who are less than 300 meters from the exchange. Customers who are between 300 meters and 1 kilometer from the exchange get a 13 Mbps symmetrical service. For those beyond this limit, Bostream offers 8Mbps/800kbps service (the same service as Telia, although at a lower price).

Other key features of these services:

- The price is high compared to the average European broadband offer, but low on a per-megabit basis.

- All three operators are offering VoIP. B2, for example, has a voice offering at SEK99 per month, plus call charges, which has attracted 50,000 customers, or more than 25 percent of its customer base.

- VoD and other video services are less important, at least for now.

- In some cases, the MMB offer is limited to customers who are very close to the exchange. For example, Bostreams 26 Mbps offer requires that connected homes be 300 meters or less from the exchange.

Trend Impact

The move to higher-speed broadband in Sweden is a harbinger of similar moves in other European countries. Although multi-megabit broadband is already available in some other countriesnotably Belgium and ItalySweden is pointing the way towards a highly competitive environment that will push Europe in the same direction as pioneering Asian countries such as Korea and Japan. There are no longer any compelling technical reasons that service providers cannot push up to higher broadband speeds. The maturation of unbundled local loop provision will encourage competitors to the incumbent telcos to move to higher speeds as a competitive differentiatorultimately forcing the incumbents to follow suit.

We expect almost all broadband providers will move their most valuable customers to 2 Mbps or more over the next 1 to 3 years. Although we can expect entry-level packages at lower speeds to persist for a while, we expect providers will eventually drop these packages and focus instead on building the value of the proposition with add-on products to maintain a low entry price point for certain demographic segments.

Vendor Recommendations

- Prepare to take your customers (and non-customers) to true broadband speeds. Sweden is not the only country in which customers have an appetite for the highest possible speed, and we anticipate most BSPs will move to multi-megabit services in the next 1 to 3 years. Helping them to make this transition will help to build future business pipelines.

- Help service providers identify valuable add-on services. These services will be increasingly important, but many service providers are not sure which services will generate most value. Vendors can help them to make the business case.

- Make a business case internally for moving to higher speeds. This case should focus on the fact that early adopters already understand the value of speed, and once captured (or retained), are unlikely to switch in the short term given current low churn levels.

- Move quickly to add value to the basic proposition to consolidate the relationship with customers. Speed and price are currently the central selling points for broadband, but medium and longer-term relationships will only be maintained by adding other products to the basic proposition including exclusive entertainment, security, telephony, video telephony, home networking, and other communications services.

2004-07-12

Notícias – Press-Releases